An investor recently asked:

How do I evaluate Capitalization Rate on an apartment building priced at $1.3m with gross rents of $84,000?

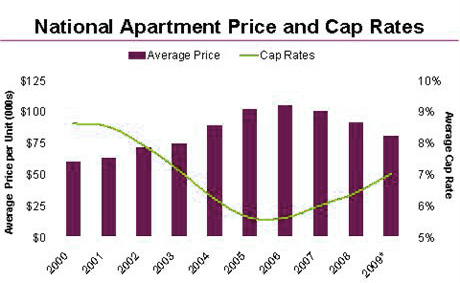

The Capitalization Rate of an apartment building is used to measure its value against other assets in a similar class. The Capitalization Rate is built on the Net Operating Income which must accurately reflect the fixed expenses of an investment property.

Gross rents use to be the standard way to measure the value of an apartment building. It was a simple formula, for example; a building priced at $1.3m with gross annual rents of $84,000, would have a GRM or Gross Rent Multiplier of 15.48. Simply use this formula:

$1,300,000 / $84,000 = 15.48 or PP / Gross rents = GRM (more…)

Filed under Investing in Multi-Family, Uncategorized · Tagged with capitalization rate, GRM, gross rent multiplier, net operating income, apartment building values, cap rate, multi-family investing, multi-family real estate